ELA proposes 24 specific steps for “a fair exit” from the Covid-19 crisis

ELA presented the political document entitled ‘Towards a fair exit’, in which it analyses the current crisis due to Covid-19 and advances that “the exit will not be neutral and it will need very ambitious, specific steps in order to ensure that the working class and the most disadvantaged groups and people do not, once again, pay the consequences, as occurred after the 2008 financial crisis,” ELA has quantified the new income in Companies and Patrimony (to which the Personal Income Tax monies must be added) and this figure would rise to 3,750 million Euros in the Autonomous Community of the Basque Country (ACBC) and 900 million in Navarre, which shows it would be perfectly feasible to be able to carry out the proposed steps regarding an increase in expenses.

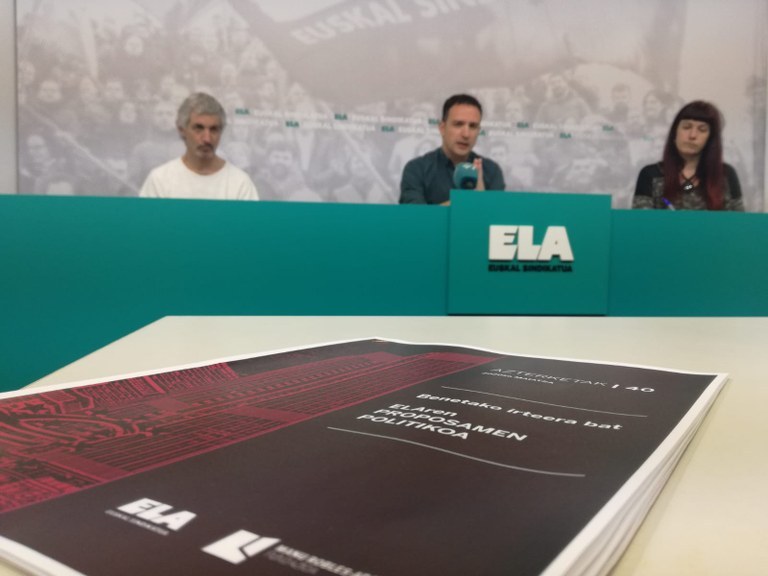

Mitxel Lakuntza (General Secretary of ELA), Maialen Aranburu and Mikel Noval (Executive Committee of ELA) have presented 24 specific steps, with regard to the aforementioned document, which will be used as the guide for ELA’s work over the next few weeks. Amongst others, raising taxes on the highest incomes, companies and on capital (20% surcharge on Companies, maximum of 60% on Personal Income Tax); publicising the public outsourced contracts in the health care and social care areas (care homes, ambulances, etc.) and consolidating the non-permanent employment in the Administrations (currently, a third of the contracts are temporary and insecure both in the ACBC and in Navarra); achieving a minimum income of the Minimum Wage for the unemployed and those receiving the ‘RGI’ (Guaranteed Income); and creating a public bank in Navarra, as well as bringing Kutxabank back into the public domain.

The 24 steps proposed by ELA:

INCREASING PUBLIC REVENUE

- Corporate Tax: remove the deductions and establish a special surcharge on the Corporate Tax form for 2019 equivalent to 20% of the profits for 2019. In this way, in the ACBC 1,750 million Euros would be obtained, along with 400 million in Navarra.

- Capital Gains Tax, wealth tax and tax on large fortunes. A specific surcharge should be established that is progressive and ranges between 1% and 10%. In this way, around 2,000 million Euros more would be collected in the ACBC and 500 million in Navarra.

- More progressive Income Tax: modifying the scale, the maximum marginal rate to 60%; removal of the specific capital rate. The quantification would depend on the increasing progressiveness of the scale.

- Halting large infrastructures (High Speed Train, South Railway Bypass, Gran Bilbao underground tunnel, Navarra Canal,….) and using this money for social budgets.

- Increasing debt to face up to the expenses, which means not accepting the existing limits of deficit, debt and the expenditure rule.

STRENGTHENING THE PUBLIC SECTOR

- Removing the budgetary deficit in Health and Education with respect to the European average over a 3 year period, which is equivalent to 1,800 million in Health and 660 in Education in the ACBC and 427 million in Health and 338 million in Education in Navarra.

- Consolidating the employment of all temporary personnel in the Administration (ACBC and Navarra).

- Publicising the outsourced sectors, such as care homes, home care, ambulances, cleaning… guaranteeing the subrogation and consolidation of the jobs.

GUARANTEEING SUFFICIENT INCOME

- The amount of the ‘RGI’ and the ‘RG’ (Guaranteed Income) at 100% of the Minimum Wage (1,108 Euros in twelve pay cheques) for people living alone and an increase of 50% per additional member of the household living together.

- Supplementing pensions up to 1,080 Euros per month.

- Guaranteeing a minimum income equivalent to the Minimum Wage for all unemployed people.

- Supplementing the ‘ERTEs’ (Furloughed personnel) due to the Covid-19 to 100% of their salary.

ACKNOWLEDGEMENT OF RIGHTS, PUTTING LIFE AND CARE AT THE CENTRE

- Guaranteeing the subjective right to the fact that all the dependency situations should be covered by a public, universal, free and high quality system in the Social Services Laws.

- Guaranteeing the subjective right to access to social housing, as well access to basic goods. A limit to be placed on house rental prices.

- Equating the rights of domestic workers to other workers (general social security regime, workers’ statute and occupational health.)

- Reorganisation of times and shared responsibility of the tasks carried out in the home.

- Moving forward towards general administrative regularisation, guaranteeing civil registration.

EMPLOYMENT AND SOCIAL AND ECOLOGICAL TRANSFORMATION OF THE SYSTEM

- Reduction of the working week to 35 hours (minimum 20).

- Minimum wage of 1,200 Euros.

- Bringing an end to the wage and pension gap between men and women.

- Turning part-time work (mainly imposed on women) into full-time work.

- Increasing the Work Inspection personnel by 100 people in the ACBC and by 50 in Navarra.

- Bringing Kutxabank back into the public domain and creating a public bank in Navarra.

- Devoting the budget items marked out for company internationalisation (used for de-localisation of production), to making the economy local once again and to promoting green jobs.

Read document (Spanish version)