In the Basque Autonomous Community, large companies pay less than one euro out of every ten that they earn in taxes

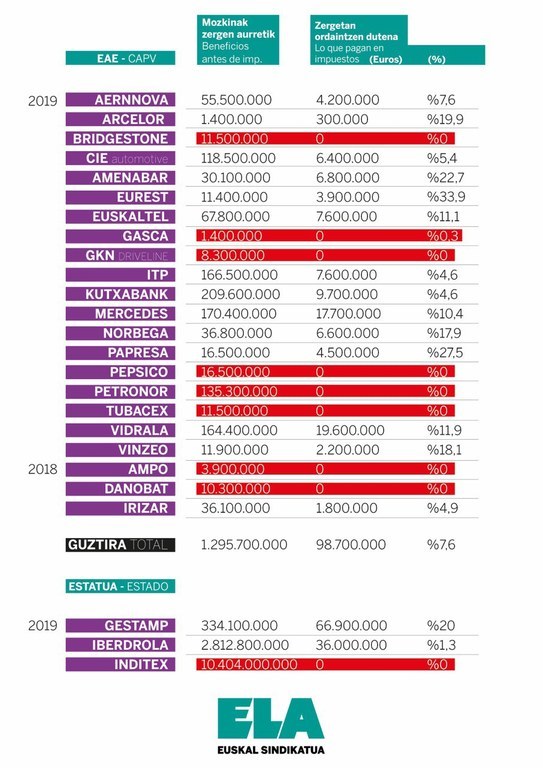

ELA has analysed the official accounts of the main companies in Euskal Herria, as well as their audit reports. According to these official accounts for 2019 (the last year for which there is information), 22 companies in the ACBC obtained profits reaching 1,295 million euros. However, amongst all these companies they only paid 98.7 million in Corporate Tax. That is to say, the real rate for these 22 companies regarding this tax was just 7.6%. In other words, the Basque treasury did not receive 225 million euros for these companies alone, an amount that could have been collected if an effective rate of 25% without any exceptions were to be applied to Corporate Tax, as ELA is proposing. The General Secretary of ELA, Mitxel Lakuntza, affirms that “it is not good for the country that money is not being collected for healthcare, the care sector, education or to save employment,” He also recalls that we are lagging behind the European Union in aid to save employment and he draws three conclusions: the large companies pay either little or nothing; the message that is transmitted is that those that have the most, pay the least; and the tax regulation is tailor-made for these companies because there is a clear collusion between the governments and the employers.

With this in mind, ELA concludes that there is a significant margin to be able to considerably increase the taxes that the companies pay, “something that is completely demandable form an ethical point of view, for example, to make the companies that are not paying a single euro on their enormous profits contribute accordingly to the development of public services and social protection”. He adds that there is a clear political responsibility with regard to this situation. “The collusion between the political and economic power is made obvious in questions as important as this one. The revolving doors and taxation are two sides of the same coin,” he affirms. The General Secretary of ELA, Mitxel Lakuntza, adds that tax regulations are tailor-made for these companies which “are the ones that call the shots in tax policy. They are the Basque lobby. Both ethically and socially this is indefensible”.

The trade union denounces that there are particularly striking, scandalous cases, companies that do not pay a single euro in Corporate Tax. This is the case of Petronor (with 135 million in profits); Tubacex and Bridgestone (with 11.5 million); Pepsico (16.5 million); or GKN (8.3 million). What is more, Lakuntza responds to Petronor, which accused ELA of demagogy at the same time as demanding the trade union to reveal its information. “Well, here is the data, but the employers know this data better than us. They work for this, in order to avoid paying taxes”.

Other representative companies also pay very little tax with respect to their profits. Examples of this are Mercedes Benz (10.4 % of their profits); ITP (the effective rate for which is 4.6 %); CIE Automotive (5.4 %); Aernnova (7.6 %); Kutxabank (4.6 %); Euskaltel (11.1 %); or Gasca (0.3 %).

In the ACBC, only three of the companies analysed paid over 20% of their profits in Corporate Tax: Eurest, with 33.9 %; Papresa, with 27.5 %; and Construcciones Amenabar, with 22.7 %. The payment made by Arcelor Mittal Olaberria approached this figure in 2019, paying 19.9% of their profits.

Examples in the Spanish State

There are other companies acting in our territory, which have a high profit level and that pay virtually no tax. Two clear examples of this are Iberdrola and the Inditex Group.

Iberdrola, a company that the Basque institutions present as an example, obtained profits of over 2,800 million euros in 2019, but only paid 36 million euros in Corporate Tax; that is to say, 1.3% of their total profits. “If it is an example of anything, it is of fiscal malpractice,” ELA denounces.

The Inditex group (formed by 8 brands amongst which is Zara) obtained 10,400 million euros in 2019 and did not pay a single euro in Corporate Tax. “It is obvious that Amazon is not the only company that uses fiscal engineering to avoid paying taxes. The main owner, Amancio Ortega, uses donations to institutions (for example, healthcare equipment) to clean up the group’s image. It would be better to pay taxes on the profits obtained.”

If the minimum effective rate of 25% demanded by ELA were to be applied, Iberdrola would have to have paid 703 million; 667 more than it paid in Corporate Tax. In the case of the Inditex group, we are talking about 2,600 million.

If the effective rate of Corporate Tax for the companies in the ACBC were to be calculated taking into account the proportional part of the profits from Iberdrola and Inditex generated in the ACBC, this effective rate would be even lower than the abovementioned 7.6%.

Cooperatives

A special mention should be made to the little or no payment of taxes by the cooperative companies analysed. Therefore, Ampo did not pay a single euro for its profits; Danobat also paid virtually nothing (only 0.1 %), whilst Irizar hardly contributed anything with 4.9 %. “The fact that the cooperatives hardly pay any Corporate Tax is unacceptable,” the trade union emphasises.

ELA’s proposals

The trade union demands a tax reform before the summer that incorporates, amongst other steps, the establishment of the real effective minimum rate, without any exceptions, of 25% for Corporate Tax. It underscores that this reform must incorporate a considerable increase in the tax to be paid on company profits, wealth and for high incomes, in line with the proposals made by the trade union in May, 2019, in order to face up to the healthcare, economic and social crisis of COVID-19.

To do this, they are urging a specific commission to be started up immediately in the Basque Parliament, in the General Assemblies and in the Parliament of Navarra, with participation by the trade union and social organisations, in order to debate the tax reform.

It announces that a campaign will be developed to socialise the true tax situation, questioning the institutions and political parties to ensure that they take on an urgent tax reform in Hego Euskal Herria, and he will request meetings with the Lehendakari, the General Representatives, EH Bildu and Elkarrekin Podemos. He also announces mobilisations over the next months.